Bonds prize: Bonds Prize How much tax on prize bond is in Pakistan? In Pakistan, the tax on prize bonds varies depending on the Filer and non-filers status. The prize bond tax deduction rate for filer is 15% and prize bond tax deduction rate for nonfilers is 30%.

However, if the prize bond holder is a filer, then the tax and prize bond tax deduction rate 2023 on the prize money is reduced.

- For filers, the tax rate is 15%, and

- For non-filers, the tax rate is 30%.

It is important to note that the tax on prize bond winnings is collected at source by the State Bank of Pakistan, and the prize money is paid out after deducting the applicable tax.

Prize bond tax calculator

The Detail of tax deduction on prize bond 2022 23 is given below:

How much tax is on Rs. 100 prize bonds in Pakistan?

15% tax is deducted from the filer and 30% from the non-filer. There are multiple other benefits of filing a return in Pakistan.

100 prize bond prize amount after tax

| Prize Money (PKR) | Filer (15% Tax) | Nonfiler (30% Tax) | |

| 1st Prize | 700,000 | 595,000 | 490,000 |

| 2nd Prize | 200,000 | 170,000 | 140,000 |

| 3rd Prize | 1000 | 850 | 700 |

1st prize 700,000

Prize Money after-tax deduction Filer (15%)

700,000 * .85 = 595,000/-

Non-filer (30%)

700,000 * .70 = 490,000/-

2nd prize 200,000

Prize Money after tax deduction

Filer (15%)

200,000 * .85 = 170,000/-

Non-filer (30%)

200,000 * .70 = 140,000/-

3rd prize Rs. 1000/-

Prize Money after tax deduction

Filer (15%)

1000 * .85 =850/-

Non-filer (30%)

1000 * .70 = 700/-

Note: The face value of the prize bond of Rs. 100 is also added with the amount of prize money either first prize, second prize, or third prize, and in both cases, if you are a filer or non-filer.

[divider style=”solid” top=”20″ bottom=”20″]

How much tax is on Rs. 200 prize bonds in Pakistan?

15% tax is deducted from the filer and 30% from the non-filer. There are multiple other benefits of filing a return in Pakistan.

200 prize bond prize amount after tax

| Prize Money (PKR) | Filer (15% Tax) | Nonfiler (30% Tax) | |

| 1st Prize | 750,000 | 637,500 | 525,000 |

| 2nd Prize | 250,000 | 212,500 | 175,000 |

| 3rd Prize | 1250 | 1062 | 875 |

1st prize 750,000

Prize Money after tax deduction

Filer (15%)

750,000 * .85 = 637,500/-

Non-filer (30%)

750,000 * .70 = 525,000/-

2nd prize 250,000

Prize Money after tax deduction

Filer (15%)

250,000 * .85 = 212,500/-

Non-filer (30%)

200,000 * .70 = 175,000/-

3rd prize Rs. 1250/-

Prize Money after tax deduction

Filer (15%)

1250 * .85 =1062/-

Non-filer (30%)

1250 * .70 = 875/-

Note: The face value of the prize bond of Rs. 200 is also added with the amount of prize money either first prize, second prize, or third prize, and in both cases, if you are a filer or non-filer.

[divider style=”solid” top=”20″ bottom=”20″]

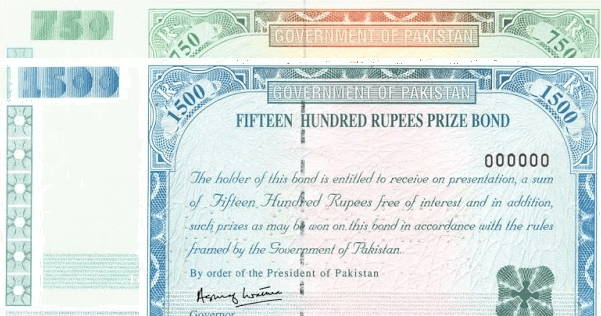

What is the tax on 750 prize bonds in Pakistan?

15% tax is deducted from the filer and 30% from the non-filer. There are multiple other benefits of filing a return in Pakistan.

750 prize bond prize amount after tax

| Prize Money (PKR) | Filer (15% Tax) | Nonfiler (30% Tax) | |

| 1st Prize | 1,500,000 | 1,275,750 | 1,050,750 |

| 2nd Prize | 500,000 | 425,750 | 350,750 |

| 3rd Prize | 9,300 | 8,655 | 7,260 |

1st prize 1500,000

Prize Money after tax deduction

Filer (15%)

1500,000 * .85 = 1,275,000/-

Non-filer (30%)

1500,000 * .70 = 1,050,000/-

2nd prize 1500,000

Prize Money after tax deduction

Filer (15%)

500,000 * .85 = 425,000/-

Non-filer (30%)

500,000 * .70 = 350,000/-

3rd prize Rs. 9,300/-

Prize Money after tax deduction

Filer (15%)

9,300 * .85 = 7,905/-

Non-filer (30%)

9,300 * .70 = 6,510/-

Note: The face value of the prize bond of Rs. 750 is also added with the amount of prize money either first prize, second prize, or third prize, and in both cases, if you are a filer or non-filer.

[divider style=”solid” top=”20″ bottom=”20″]

How much tax is on 1500 prize bonds in Pakistan?

15% tax is deducted from the filer and 30% from the non-filer. There are multiple other benefits of filing a return in Pakistan.

1500 prize bond prize amount after tax

| Prize Money (PKR) | Filer (15% Tax) | Nonfiler (30% Tax) | |

| 1st Prize | 3,000,000 | 2,550,000 | 2,100,000 |

| 2nd Prize | 1,000,000 | 850,000 | 700,000 |

| 3rd Prize | 18,500 | 15,725 | 12,950 |

1st prize 3,000,000

Prize Money after tax deduction

Filer (15%)

3,000,000 * .85 = 2,550,000/-

Non-filer (30%)

3,000,000 * .70 = 2,100,000/-

2nd prize 1,000,000

Prize Money after tax deduction

Filer (15%)

1,000,000 * .85 = 850,000/-

Non-filer (30%)

1000,000 * .70 = 700,000/-

3rd prize Rs. 18500/-

Prize Money after tax deduction

Filer (15%)

18500 * .85 =15,275/-

Non-filer (30%)

18500 * .70 = 12,950/-

Note: The face value of the prize bond of Rs. 1500 is also added with the amount of prize money either first prize, second prize, or third prize, and in both cases, if you are a filer or non-filer.

[divider style=”solid” top=”20″ bottom=”20″]

Check the State Bank of Pakistan‘s official website for details.

Frequently Ask Questions (FAQs)

How much tax or tax deduction is on prize bonds in Pakistan?

The tax rate is 15% for filers and 30% for nonfilers.

How much tax is deducted from prize bond money?

The tax on prize money is deducted at the source, the rate is 15% for filers and 30% for nonfilers.

What is the tax on 750 prize bonds in Pakistan?

Prize bond tax deduction rate for nonfiler.

Prize bond tax deduction rate 2023.

How much tax on prize bonds is in Pakistan?